I added a new picture of my hair to yesterday’s post. I took out the hair-clip last night and was admiring the streaks, and thought my stylist would not be pleased if she knew the only picture I’d posted of it was the one that made me feel uncertain about them. But I think the new photo is TOO flattering: we have good light in the bathroom. ANYWAY. LIKE THIS MATTERS.

I want to talk about making kids save for college. Rob and William are still working their summer jobs, and it’s going well, and they’ve gotten their first paychecks, and I’m not sure what ruling to hand down from the mountain. We’ve talked with them about college expenses, and what they can expect us to pay and what they can expect to need to cover themselves, and we’ve also talked about other uses for money such as charitable causes, fun stuff, and investments. Right now our kitchen white board is covered with possibilities, and Rob and William are less interested than I am in going over all the not-very-different options again and again.

The system my parents used for me was this: When I was earning small beans (like babysitting irregularly at $2-3/hour), I had to put 10% to charity and 50% to college; 40% was mine to keep. When I was working lots more hours (like a summer job), it was 10% to charity, 70% to college, 20% keep. This sounds a little pitiful, but 20% of a full-time job is a lot of money for a teenager with very few expenses: I remember going up and down store aisles TRYING to find something I wanted to buy. Another detail of this system: I remember asking what would happen to the money if I DIDN’T go to college, and my parents said they would give it back to me for all the new-adult start-up costs such as security deposits and furniture. They would have had me do this system either way; we were just calling it “college savings” because I WAS planning to go to college. I remember that made it feel more like My Money: they were making me save for my own future, they weren’t taking the money away from me.

The system Paul’s parents used for him was this: no system. He kept all the money he earned. And of course he didn’t save any of it for college: I don’t think I would have, either, if I hadn’t been made to. Once he was IN college, he used a lot of his earnings to pay for college, because by then the expenses seemed real to him, but he still ended up with big college loans that were a beast for us to pay off. When we didn’t know how to come up with the money for a new battery for the car, it made me clench my teeth to imagine him as a teenager blowing $200/week.

We are trying to decide what kind of system to use with Rob and William. I’m not doing 10% charity anymore (my parents are Christian, so 10% was a biblical instruction we were following), and it seems like a lot. But we’d like to get them in the habit of giving away some of their money, and I find it fun to talk with kids about what causes they might want to support. So, maybe 5%? If they earn $200/week after taxes, that’s $10/week to charity.

I think 20% is the right amount for them to keep. From a $200/week paycheck, it’s $40/week. It’s kind of high, but on the other hand it’s only for a few months of the year. I remember as a teenager feeling like it was a really nice amount to get to keep, and if it were lower I’m not sure I would have been motivated to work more hours when they were available. Paul suggested letting them keep a flat-rate amount, but I think that would have been the wrong thing for me as a teenager: I liked calculating how much more money I’d get to keep if I worked more hours, and I would have said no to extra shifts if I’d gotten the same amount of money no matter what.

Paul is very keen right now on INVESTING: he recently read a bunch of books that say the best way to retire with millions is to invest even small amounts as early as possible. I’m down with that, but also it seems to me that every dollar the kids invest in their retirement now is a dollar we have to take away from OUR retirement to cover the money they’re not putting toward college, which seems silly; doesn’t it make more sense for us to save for retirement while they save for college? On the other hand, it would be a good habit for them to get into, and by the time they’re out of college we won’t have any say over how they spend their money. If we use our influence while we’ve got it, that might pay off for them in the long run. Let’s say we have them invest 5%: that’s only $100 over the whole summer, but they could see how that amount grows. But it bothers me to see the college percentage going down and down as we keep thinking of more ideas. Paul originally put investment as 15% (the minimum, according to a book he’s reading), and I vetoed that.

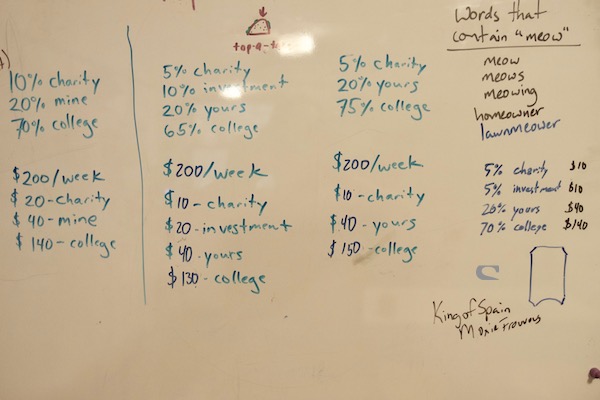

Here’s how things are looking on our white board (ignore tacos, meows, songs):

The far left is me showing them how my parents’ system worked out: the percentages, and then how those percentages look when applied to a $200 paycheck. Then we have three more sample possibilities, with the college contribution ranging from 65-75%. I think we’re leaning toward the one on the far right (squeezed in under words that contain “meow”): basically the same system as the one I had to follow, but with the tithe split between charity and investment. But the thought of all the fuss of that makes me lean toward the middle one: 5% charity, 20% keep, 75% college.

If you have kids who are of money-earning age, what are you doing about this? Or what do you have in mind for when they ARE that age? And what was the situation when you were the money-earning teenager?

I’ll be thinking all day now of “words that contain ‘meow’. ”

That’s all I have.

Same.

Also same. And lawnmeower is KILLING me. I’m so happy right now.

Pun-y words that MEOW can be inserted into would be a much longer and more hilarious list!

homeowner!

This is easy. My 16 year old doesn’t work. He has no interest and barely spends any money as it is on a $6/week allowance. Yes, you read that right. I’ve thought about having him work to save for college but it just seemed like he’d earn so little in relation to what it will cost it wasn’t worth it. I’ve thought about having him work for the real-life responsibility of it, but his work ethic (for homework, chores, etc) is excellent already. So he’s doing his summer homework, volunteering (helping produce and edit a video for the 75th anniversary of his old preschool), and going to driver’s ed school. It seems like enough structure for a kid who’s overworked during the school year.

But I keep thinking he should have a first job at SOME point before college.

I had a financial advisor friend tell me that you can borrow and find money to pay for college but you can’t borrow money for retirement. If you’re going to start retirement savings for the boys then I would go for the 15%.

This is what I’ve been told as well. But I would turn it another 90 degrees and say their income is part of what YOU are allocating toward college, thereby retaining more of your own income for YOUR retirement. So my personal breakdown would be 10% giving (not necessarily charity, but some kind of giving) 70% college, 20% keep. Just like your parents did, I guess!!

This is so smart. Thank you for sharing!

I’m chuckling over the lawnmeowing. Hee.

All the plans look great! We had a similar system when I was a kid. The only thing I wish I’d learned as a teen, when you have years of saving ahead of you, is the power of compounded interest. Good Old Suze Orman has a great website about investing for college. We have a 529 plan for the state of MN and it is very gratifying to see the money grow instead of just become less valuable as inflation marches on.

Of course, it’s all personal, what level of investing risk you are comfortable with, but I was shocked when we finally did start watching our retirement fund grow. If I’d done it as a kid, I would have started investing in my 20s, and I would have a lot more saved now.

http://www.suzeorman.com/resource-center/paying-for-college/

Unfortunately, our 529 accounts for our kids that the grandparents set up TANKED. I’m hoping they grow in the next 6 years before our oldest starts college….

2008 was a tough year for everyone. There are options for different type of risk, depending on how long you have to save. The only way to ensure that the money becomes less valuable is to not invest at all.

My philosophy with my kids was that I was doing them a favour by saving for my retirement, so I wouldn’t be a drain on them. Their job was to save for university. If they had to, they could get a loan to cover any shortfall, but they wouldn’t be saddled with my expenses when I retired. Once they were working, then their focus would switch to their retirement.

This. As someone who did financial planning professionally, you save for you, they save for their college. They can start investing for their own retirement after college. If you have any questions you know where to find me. :)

I came to say the same thing that Winds did. I definitely hear you with the concerns over student loans – I’m still working to pay mine off – but the amounts that you’re talking about for investment are so small that they won’t make a huge difference by the time their college rolls around. They WILL add up to a nice chunk by the time they get to retirement. The plan under the meow list is probably the one I would go with. It’s not clear whether you all plan to have them open IRAs (I don’t know if there are costs for small deposits) or just general investing. If you’re doing general investing I would toss the small amounts in an online bank account (we use Ally) until they have enough saved up to buy into an index fund (or you could put it in a CD). That way you get a small percentage of interest while it’s sitting until you can get to the threshold for the fund. Ours is $250 minimum I believe and has been tracking pretty well to the overall market.

My dad is an accountant/slave driver. My four siblings and I grew up working and SAVING. None of us borrowed money for college. My dad and his dad were big on investing, so we DID have investment income from our stock portfolio. My dad and his dad (until he died) invested money for our kids too, which was very fortunate for us. So they have that investment income now to use for college. We sell their stocks off as college approaches to put in their college account.

Retirement money can be figured out by your kids when they graduate college. It’d be best for them to NOT have too much in collge loans. If they don’t have to pay college loans, then they will have more surplus to pay into retirement fund.

Our kids work VERY HARD. There is an expectation that they rake in what they can. I believe coach has told them that they can spend @10% of what they make. They rarely spend that though. They are too busy working, and I buy their clothes for them. They aren’t real demanding about wardrobe needs. I even give them money from time to time if they are going to the movies or something.

My three older boys work as caddies and the 14 yr old also cuts lawns. They earn about 4,000 a summer, plus Tank makes another 2,000 on lawns. They start caddying when they are 12 or 13, so it gives them time to save quite a bit. They get excited about how much they’ve saved, so this also keeps them from spending much. I think the general family budget conscious mentality is infectious.

As far as charity goes, my folks didn’t have us contribute (but we were aware that they did, because they had $) but we do as adults. Our boys attend mission trips and are involved in church. Coach and I teach religious ed. I think it’s important to lead by example, and I think so long as they know being involved to help others is important until they can afford to contribute monetarily is sufficient.

I think my dad could write a book on investing and saving for college. My boys often call him to tell him if they make a big tip or if they caddy twice in one day. They do take time for sports but they rarely miss an opportunity to caddy.

Now if I can just find someone who wants mini to babysit regularly. Her brothers say she won’t be able to survive as a caddy. I babysat like crazy growing up. Again I started so early, I didn’t really consider spending my hard earned money. Once a month my dad would have me empty my drawer of cash so he could deposit it. He was always blown away at the crumpled bills in my drawer. I was 12.

Good luck with your system. Maybe since I didn’t have college loans, they freak me out. With 6 kds, we recognize there is no way that our kids can avoid loans. If the kids all attend colleges that don’t cost crazy amount, then they should each be able to pay two years, we pay one, and they borrow for the last one.

Your plan is very smart! Looking back, I started working at 16 and have pretty much always held a job since then. My parents never created a system, but my economics major, super-practical father (the guy reads investing magazines for fun) continually pounded home the importance of saving and investing.

One question/note – on the college savings front, where is that money actually being saved? Is this just a special savings account, a 529 college savings plan or something else? Since you mentioned investing, another option would be putting some of that money into a regular investment account (mutual fund) or Roth IRA. This offers the flexibility that the money could be withdrawn for college expenses, or be left alone and used as savings toward retirement. (You’d need to check the rules on the Roth, as I believe you have to contribute for 5 years before withdrawing.) Most of my college expenses were covered by scholarships (I was lucky – scholarships were more generous in those days). But I did end up tapping into my investment account my senior year for a study abroad program. So just a thought that would satisfy Paul’s interest in investing, while also not tying up their money until retirement.

I really highly recommend the book Tge Opposite of Spoiled by Ron Lieber. He talks about all of this — charity, investment, jobs — and while he won’t give you a specific percentage that your family should use (it’s all about your values) it gives some really helpful perspective. It addresses all ages, from very young kids to teens, and families of all budgets, from scraping by to millionaires. So I think pretty much anyone could get something out of it. I really liked the approach.

I’m probably a heretic, but here goes:

My kids get an allowance. My kids have chores. The two are not connected: the allowance is so they will learn to handle money, the chores are because we are a family and everyone needs to contribute.

Your money is yours to spend as you see fit. The kids do have bank accounts (kid ones that a local bank offers), and they put birthday money and saved money from their allowance in the bank.

They know my husband and I save money and invest and give to charity, and we’ve talked about how we do that and why, but kids are free to save and donate as they choose. It’s not imposed, because to me that wouldn’t count (remember Mrs. Jellyby in Bleak House?) as charity or as learning to handle money. The thing is, they do save without being told to (other than the eternal response to any requests, “That’s what you have an allowance for”) and they do donate to charity without being told to. The oldest has even put donations to charity on Christmas lists.

The only one who has earned money is the oldest. We are paying for college, including room, board, & books, but he is responsible for his spending money, including having funds for starting off as an adult when he graduates.

Slim, we’re like you with the chores and allowance, but not tied to each other thing. That way the kids can’t say “I don’t need money, so I’m not doing my chores”. Their routine chores are done because they are members of the household and contribute to the mess that needs to be cleaned up; the allowance is to teach them to handle money.

And I’ve seen this in adults, too — a friend complained that her husband wasn’t doing enough housework, and she was outraged because she earns more money than he does.

I’d be outraged because he’s slacking.

I was a retirement specialist for a bank so I was fixated on how important it is to start early. We were fortunate that our boys’ college tuition was put away very early, so when they worked, they saved 50% and were able to spend the additional 50%. We matched what they saved and put it into an IRA account. My 24 year old has $33K in an IRA (most of that is growth on about 9K of deposits). Now that they are working, we strongly encourage them to max out their 401(k) contribution; I know the oldest does, not sure about the younger son. Obviously we were fortunate to be able to do this; the growth has made a big impression on the boys and they are encouraged to save because of it.

This may have changed, but I remember from my own college financial aid days that investments in my name were counted as eligible toward the family contribution part of FAFSA? So it might’ve better to not do actual retirement savings before college expenses are cleared. (But this is all based on vague recollections of my dad being super irritated 20+ years ago, and I think it was just stocks I got as a little kid but not in an IRA or whatever, which might make a difference.)

I babysat all through high school and had a couple of jobs before college, but things were kind of falling apart at home so sometimes I got to keep my income (and blew it on things like Starbucks and gas for random road trips and going to the movies) and sometimes I got to pay the utilities and buy my little brother’s shoes and school fees.

As a jaded Millennial, I would just note that the weekly difference between your highest and lowest college savings percentages is $20. Over twelve weeks of a summer job that’s like the cost of two used textbooks. I appreciate the pinch (the lesson?) of saving “for college” and I think the job has a lot of life lessons as well, but monetarily I’m not sure it makes much difference. I would go with Plan 2, under the adorable taco.

I was thinking something similar. All the plans are fairly close, and the overall difference is a used textbook or lab goggles and lab coat or a course materials fee. Not AND. Just one of those things will be covered by the difference.

Agree with these two. I don’t think the amounts of money you’re talking will make any difference at all in college loans. That being said, I think it would make a huge difference in starting their retirement savings. The best thing my parents did was start a Roth IRA for me when I started working at 16. Even when I wasn’t interested in it, they had me contribute the full amount I was eligible for every year. Now I’m the only 30yr old I know that doesn’t have to worry about retirement. Compounding interest is magical. If you’re starting early, small amounts of money make a big difference.

This. More thoughts on the topic below, but — yes.

We do 50% education savings, 50% kid’s discretion. We don’t mandate charitable giving, but they contribute their own money for school-initiated charitable causes (we match funds) and encourage volunteerism.

I’ll go back and read all the comments, but here is our situation. I’m not sure it will be helpful, because we live in Canada and our investment vehicles are different…

My husband and I have what is called RESPs for the kids. Up to a maximum amount per year, the Canadian government will top off our contributions to an RESP with an extra 20%. So our deal with the kids is, they get whatever we’ve saved for them to go to school with, but they pay for the rest. My siblings and I all had the whole shot paid for by our parents, and I’m the only one that took school seriously and only cost them the 4 years of my undergrad program (I paid for grad school myself out of the stipend my university offered in my program) – all my siblings spent at least 50% longer in school than they should have to come out with the diplomas and degrees they eventually earned. My brothers in particular seem to fail classes and switch programs expressly because while they’re in school my father and stepmother fund their entire lives, and don’t want them to work at all so they can “concentrate on school”.

Our kids aren’t old enough to have summer jobs, but when they do, we will make sure they are aware of what they will need to save for (university/house/retirement/etc.) and just how incredibly smart it would be to save for these things as early as possible, but then they will sink or swim on their own. We won’t have any required percentage for divvying up the money that they make.

However, I’m a squirrel and extremely good with money, and I love sharing tips and advice about money with my kids. For example, I started my first bank account when I was 11 because I wanted to save up to eventually buy a house. I’m not particularly worried about my kids blowing all the money they make. My 11 year-old’s summer project is to start an Etsy store and make at least $50 this year.

Lawnmeower!

My parents had us save 50% of our paychecks (our gross pay, before tax), and then we kept the rest. We bought a lot of our stuff: clothes, shoes, prom ticket, etc. etc., so it was good to have that much money. We also learned how much money comes out of a paycheck for taxes, which was good.

When we were in college and making more $$ than we did in high school, my father helped us set up Roth IRAs. We put a set amount in that each summer (maybe $300-400??)

I thought this was a good system, and I plan on using it with my kids. I like its simplicity and its emphasis on savings. My husband grew up like Paul – no expectations for saving, etc., and I’m more money-savvy than he is.

My siblings and I all had joint checking/savings accounts with our parents until we turned 18, and we saved our money there.

We did not give money to charity as teenagers, but we do now as adults.

Testing to see if I can comment….

Oh yay, I can comment!

The way my parents did it was tell me that I was on the hook to pay for 50% of my college, and they would pay the other 50%. Any scholarships I got went to my half. So I was incentivized to find scholarship $$, but also had to work to cover my half of the costs. I worked part-time during the school year and full time + an additional job during the summers. This may not work for a family with 5 kids though, I realize. I guess what I’m suggesting is to give them some responsibility on the PAYING for side of the equation, rather than just the EARNING side.

Also, when I was young my parents wanted to encourage saving/investing, so they would “match” any dollar I chose to invest rather than spend. So if I invested my $20 in birthday cash, they would put $20 in as well. Then when it came time for college, I used that money to pay for my half of college (in addition to the income I earned from working). This would probably only work for younger kids who have some time to save/let the money grow.

Every so often, I run into something that highlights what a weird kid I was.

My parents had zero input into what I was doing with the money I earned as a teenager, and I would have been absolutely furious if they’d even tried to tell me what I had to do with it. The idea that you have a whiteboard where you’re working it out because that’s part of your role… it seems really strange to me.

That said, I was an angrily independent good kid– never had a curfew because it was never needed, didn’t touch alcohol or drugs, kept my room clean, was a good student, had regular jobs from the age of 12 onwards, and saved practically all of the money for college. How I managed to meld such a colossal attitude with doing all the things a parent wants their kid to do is kind of funny in retrospect.

What I’m hoping to do with my own daughter (who’s currently too small to want to do anything with money) is to have her come up with her plan, but for me to have influence over it. I think people are more likely to follow through on the ideas that they come up with themselves. Plus kids will sometimes surprise you by coming up with something more rigorous than you would have dreamed of imposing on them. What have the boys said about what they want to do?

I agree with this that I would want my kids to have a pretty loud voice in the conversation. What your kids need in terms of structure and guidance depends on what their personalities and maturity levels are like, and it might even be different for Rob than for it is for William.

As a teenager, I tended to save everything I earned, even when I should have occasionally enjoyed the fruits of my labor. But I was an overly responsible, anxious kid, and I didn’t get much support or structure from my parents in this regard. For college, they said they had put money in mutual funds when I was born that were projected to cover one year of in-state tuition and room and board. Anything else was on me to figure out. I made it work, but it probably would have been helpful if my parents had conversations with me about how to manage money based on what’s important to me. I might be better about knowing when it’s okay to treat myself a little now. My brother, oddly enough, had the exact opposite problems as me, and also never finished college.

I did have a really interesting conversation with my dad once in which he explained why you pay more interest early in the life of a loan, and how it really benefits you in the long run if you can start chipping away at the principal right away with extra payments. I wish I had gotten more of that kind of information from my parents, but I’m not sure whether all kids would be interested.

Echoing what somebody below said about retirement investing, check out this link: http://mynextbuck.com/turning-5000-into-110000-tax-free-–-all-it-takes-is-time/

My father-in-law showed me a chart of Example 2 when I was 28, and I immediately opened a Roth IRA online the next day. The idea that you can contribute money for ten years starting at age 25 and have more money at retirement than somebody who contributed for THIRTY years starting at age 35 still BLOWS MY MIND. I think you have to be 18 to open a Roth IRA, but I can hardly imagine how much even a modest contribution would grow if you started that young.

My oldest is 16 and this the first year that she has worked. I am a single parent, and when she turned 16 I knew she would need a car (as I am often not home). After MANY arguments with my parents I caved (for REASONS) and allowed them to lease a vehicle for her. They paid the down payment and the monthly payment is low enough that it fits in my budget. However, SHE doesn’t know that. So half her paycheck (no matter the amount) goes to me to “reimburse the lease payment”. However this money is just piling up and I fantasize about rolling around in it. I don’t expect her to cover the car payment, but I feel like it’s making her more financially responsible. Although she did just buy a giant inflatable dill pickle so… The money she gets to keep she is free to spend however she likes, but has to remember that she needs to pay for gas out of that money. I suspect I’ll probably open a separate bank account for her “car payment” and use it for college because I don’t have money set aside for either of my children for a college education. I always operated under the view that they could take out loans. My youngest (6) LOVES money and LOVES to save and count her money. When she gets money for whatever reason I have her put 50% in her bank account and the other 50% goes in to her piggy bank. She will occasionally pull some out to buy some toy that I deem “unnecessary” and she views as THEBESTTHINGEVER!! For what it’s worth, when I was a teen, my parents didn’t dictate what I had to do with my earnings and they always provided me with a (brand new every two years) car. It took me a loooong time (well into adulthood and parenting) until I was financially responsible. Even now, I think I have a very unhealthy relationship with money.

The time when I most needed money was when I graduated college, moved to a new city, and started a low-ish paying job. If there is some way to set aside some money for that now, I think that would make a really big difference if the goal is to not move home after graduation. (That was my goal, and I was also the eldest of 5.) A young graduate would be really well positioned to start his/her independent life with a healthy savings account which would give him/her some freedom to make choices other than moving home immediately.

Of course, I don’t know the particulars of your financial arrangement re: college payments, so maybe it’s better to maximize Rob’s contributions to that and minimize loans, etc. Also, I’m wondering if switching to a focus on how much he actually needs to contribute to college (a defined number) from a percentage of what he may or may not earn could be helpful? Like, Dad and I will pay $35k per year and you need to cover the remaining $15k yourself – be that with loans, savings, scholarships, whatever.

Having them put $1000 in an IRA when they are teens can change their entire lives. I would recommend that, along with a discussion about the miracle of compound interest.

$1000 at 4%, compounded quarterly for 40 years results in $4914. Not so impressive. But multiply by 10, and your $10,000 stake becomes $49,138.

Ah, but there is the value in putting aside that $1000 at the age of 16 instead of 26 – you leave it in for 50 years instead of 40 (so you don’t touch it until you are 66), and you have $7316. And, seriously, that long-term an investment generally averages a higher interest rate, so let’s examine it at .06 instead. I get over $10000, after only 40 years. $19,644 if you wait 50. All for only $1000.

I don’t think my parents and I ever officially worked out a deal when it came college expenses, but we ultimately ended up with this: they’d pay for school and any other necessary expenses (tuition, housing, groceries, etc.), and I’d cover spending money. I could have a lot of free time and not have new clothes or the latest gadgets or a car, or I could work and have some or all of those things. We ended up meeting in the middle: I worked full time during the summer but not at all during the school year. I kind of liked having money saved up and never needed to be talked into saving it, though, so the system might have been different if I’d been more careless with my money. It also may have been different if I’d gone somewhere out-of-state and/or private, since my in-state public-school tuition was relatively low compared to other options.

Another thing: my parents helped me out a lot with college, but expected me to have a lot of money saved and/or a job lined up after I graduated. I was welcome to move back home if I wanted to save some money before finding my own place, but I had to be working and saving the majority of my money if I did. I ended up doing that, and it worked out really well.

Our household growing up was a paycheck-to-paycheck situation. My parents were not financially savvy at all and did little to pass on money wisdom. If I wanted anything beyond bare necessities, I bought it myself. I certainly blew my fair share of earnings, but a lot went toward stuff like gas and maintenance for my car, toiletries, school fees. I didn’t save for college. I wish I had, but I didn’t. That just meant I was creative and careful in college. In total, I took out $7500 in loans and paid as I went for the rest. It took 5 unpretty years, but I graduated with less than $2000 in debt.

My husband grew up in an even more precarious financial situation. Our household places a lot of emphasis on saving and investing and not spending beyond earning ability. Our kids aren’t old enough to have jobs, but I make a big deal when they get birthday money. They get enough to make them feel flush ($20-40 for a 5yo and 9yo is exciting), then I go over what stocks I will buy with the rest and how much previous years’ contributions have grown.

When the kids start earning their own money, I hope they’ll be excited enough about growing those balances that a rule about saving won’t be necessary. I hate making rules, then having to defend them to independent, too-smart kids.

Nothing helpful, just an anecdote: I worked (babysitting, mowing, eventually lifeguarding) and saved half my money for college. All our lives, “Save for college!” I remember emptying out my savings account to pay for ONE SEMESTER of college and being so stunned. It was the first time I realized how lucky I was that my parents were ponying up for the rest. I mean, I knew, but I didn’t really GET IT until all those years of mowing lawns were gone in one check.

I am a generally competent adult but the idea of investing makes my brain freeze up. It really stresses me out, and I know part of it is the unfamiliarity of the task. (Control freak issues also contribute.) I would suggest that investing in a small way is an excellent teaching strategy for teens– maybe a small weekly contribution to Stash, as a low-stress low-maintenance learning tool? Being comfortable with an investment strategy at a young age could translate into more willingness to learn about investments when they have more money. (I just kept plunking money into savings accounts for a long time, because that’s what I knew.)

I still just plonk money into savings accounts, honestly – and I save a lot. Right around the time I started thinking about investing my spare change, so to speak, the 2008 crash happened, and I just can’t bring myself to do it. We contribute to my husband’s 401K, an IRA for me, and pay extra on our mortgage. But the thought of watching money I have been setting aside for almost a decade to pay for whatever emergency we might encounter or, assuming continued good luck, at least part of my kids’ college gives me hives. I think if I’d started earlier, with more of my working life ahead of me, I would have been a lot less tense about it, and I’d probably have much more saved up than we do. Then again, maybe I would have lost most of it in the crash, and now I’d be squirreling money under my mattress.

I apologize if I repeat, I haven’t read all the comments yet. I just wanted to chime in that there are investment options specifically FOR education and we have started those types of accounts for our kids that we contribute a small amount to from each paycheck, plus adding gift money from grandparents every now and then. They can start contributing to them later.

My husband’s family did 10% tithing, 20% short term savings (like for a new bike or a senior trip or dance lessons or something), 30% long term savings (college), and then 40% spending. BUT once they were teens, they had to pay for at least half of their own clothes and all their own entertainment. So it wasn’t just “fun” money.

We plan to teach our kids about tithing, but widening the definition to include all charitable giving, not just to a particular religious institution.

…does no one else now have King of Spain stuck in their head…?

Now I eat humble pie!

(Yes, and it’s going to be there aaaallll day.)

I was allowed to spend my high school income however I pleased. In college, I was responsible for my sorority dues, gas, phone, and any extra charges on my meal plan.

I clearly have read the same books as Paul. I won’t require, but will incentivize, my kid(s) to put money aside in a Roth IRA (if that is still a thing). I’m hoping to have the ability to offer to match their contribution to their Roth. The great thing about Roths are that, after 5 years, you can take out what you’ve contributed. If the kiddo starts early, he should have enough for a decent down payment for a house.

Question: what is minimum wage where you live? Here, a teenager working full time can expect to make between $300-$400 a week at minimum wage. Or are your kids only working part time? Because a couple of people have pointed out the difference between scenarios is quite low, but are those real numbers, or just sample numbers?

I think this approach is great in theory but, personally, my focus would be entirely on college fees (and spending money) at this point. My thinking is that any money made on the retirement savings would be heavily offset by student loans and the resulting interest. Plus I tend to think retirement savings work best when it’s a regular monthly amount (even if it’s small) to take the best advantage of the fluctuating cost of funds and compound interest. So I would probably try to minimize student loans as much as possible (I’ve seen people devastated for years by those), but then encourage them to start having an amount (as close to 15% as they can afford) taken automatically from their paycheque for retirement investing as soon as they get a job out of college. If it’s taken automatically then you don’t miss it the same way and, if they start at that point (early twenties) and increase it as their income increases, they’ll be in great shape come retirement. But that’s just one woman’s opinion/experience. Btw, I think “homeowner” on the meow list is brilliant.

So, I don’t know what your household income situation is (though I tend to think of it as “comfortable but not extravagant,” whatever the heck that means), nor how good (or bad) your retirement savings situation is, nor what you intend to pay toward your kids’ college educations, but that entire lack of knowledge notwithstanding … some somewhat random thoughts perhaps relevant to these issues.

The moment I can (for the record, with our credit union that will be the year he makes $25 in earned income), I will open a Roth IRA for my son which I will fund fully with my money as a gift to him. I will probably continue to fund that as fully as I can throughout his high school and perhaps college years. I don’t expect someone that age to be planning for retirement, but am a huge fan of the benefits of (a) tax-protected savings/earnings and (b) compounding. Also, I have just the one kid, so this task isn’t as daunting as it might be (though I do also have two adult stepkids and two stepgrands so far, so if I decide to do this more generally, it might get expensive. And some of those people will not benefit from the compounding phenomenon as much as others. But those are problems to worry about down the road.)

I feel somewhere between optimistic and confident that my own retirement savings is solid (see above: I am a huge fan of the benefits of (a) tax-protected savings/earnings and (b) compounding and have been investing based on those motivations from the moment I legally could). Certainly if you are not similarly situated, then focusing on improving your own future security should be a top priority, and not just for your own sake, but for your kids’.

What was done for me, and what I plan to do for my kid, is to state what I will cover and then cover it, WRT college expenses, and the rest is the kid’s problem. Now, in my case, my mom paid for tuition, fees, housing (modest housing) and an allowance ($200/month back in the late 1980s, apparently about $400 in today’s dollars) that was enough for me to eat, have water/power/phone service and do fun things occasionally. I expect I’ll do similarly for my son. We didn’t do a great job of this on my stepkids (mostly due to differences of opinion about what “reasonable” expenses we were “committed” to covering), with the result (perhaps) that we covered more than we should have and that they were less capable of managing money than they should have been by the time they graduated (college). But then again, one was good and one was lousy, so perhaps it wasn’t us, perhaps it was them.

If I had it to do over again, one thing I would never, ever do is send a kid off to college before they had and had used and managed (independently) a credit card, for a couple of years. Not one with a high limit, obviously, and not without some supervision — and protections against the most deceptive lending practices have been put into place for college kids since my stepkids were in college — but let’s just say that learning that skill set while mastering independent living and without parental oversight can lead to serious problems. I’d say the same thing about providing guidance about school choice and how much debt it is or is not reasonable to take on in order to pursue an education.

And, yeah. Last but not least I guess I’d probably just ask my kid(s) what they want to do with/about the money they earn, and perhaps encourage them to set some rules or otherwise have some mechanisms in place that ensure or at least promote follow-through, but I don’t think I’d set up a system that tells them what % they had to put where. My own experiences both as a kid and as a parent (and stepparent) have been that we say (or my parents said) “We will/won’t pay [this much] toward [that], so you must earn [this fraction of] the total cost if you want to get it.” So for example, when I started driving, my parents provided me with access to a car and some gas money (a fixed amount per month) and paid my base insurance, but I had to come up with more gas money if I wanted to do more driving, and to pay any increase over the base insurance costs that resulted from my experiences (aka bad driving/accidents), as well as repairs to the car for damages I caused. And one year into college, I bought my own car (my mom paid $500, which was 25% of the purchase price) and paid to insure and maintain it, because my parents were not providing me a car once I started college. But (as noted) they did pay for college. The point here being that they absolutely did support me, up to and through “launch,” but they also gave me space to make my own decisions about non-essentials and let me figure stuff out on my own.

So, I do not currently have kids of money-earning age, and when I do, I doubt I’ll insist on their saving anything – my parents told us every month to save something like 10 percent of our cash allowance in our piggy banks, and all I recall about this is that I felt guilty my whole childhood because I rarely did it, mainly because I rarely had the exact change. Just looking at that damn bunny bank was a major source of angst. Once I had a paying job, at 18, the money was mine to do with as I pleased. However, since they wouldn’t pay for a car, what I was pleased to do with that money was save for a car. Then, I saved to move out so I could live close to campus. Then I worked to afford rent and saved for “whatever.” This was likely due to a combination of my parents’ overall attitude toward money and my own personality, so I figure the biggest influence I can have on whether my kids become savers is to just talk about our attitudes toward money as much as we can. And maybe incentivize them with matching or “interest” on what they save when they’re younger.

As to our family attitude toward money, I really like Elizabeth Warren’s book, All Your Worth. Her main tenet is that for lifetime financial success, no more than 50 percent of your income should go to necessary expenses, 20 percent should go to savings, and 30 percent to whatever you want. I can’t remember where she categorizes charity – it might be part of “savings” due to potential tax breaks, but I think more likely, it comes out of the “whatever you want” percentage. Personally, I like to swap the savings and whatever you want percentages if I can (although 50 percent for all our necessary expenses is a stretch, sometimes, and only works at all right now because we both work).

I will probably strongly recommend this path for my kids. So, in your shoes, 50 percent for necessary expenses (given that you’re still paying for their necessities) would be for college, 20 percent could be split between further college savings and a retirement account, and 30 percent would be theirs for whatever they wanted, with the caveat that 10 percent of that “whatever” should be a charity or charities of their choice. (I tend to think of the “whatever you want” portion as more of a “not necessary for your survival” portion, so any expense we could reasonably cut out of our lives if we had to falls under this umbrella.)

Hey, wow, and now I have a plan for my own kids 10 years before I need it :)

Growing up, my parents encouraged us to save 50% of any money earned through jobs or birthdays/holiday gifts and the other 50% could be used however we like (often we’d find ourselves saving a bunch of that too towards higher price frivolity). Even as an adult, I have my paycheque deposited into one account and try to move money from it to a savings account every deposit (just can’t do 50% now that there are grown up life expenses to consider!). I also always had jars around to collect my loose change, and when the jars were full I’d roll the coins and take them to the bank, and there was always more saved up that way than expected!

I actually did save for college in high school without my parents making me, and I can remember that a lot of my freshmen year I was panicked by how quickly it disappeared. I’m one of those people who finds spending money physically painful…so maybe its a personality thing….but you might want to consider (or encourage them to consider) whether they’re liking to feel a sense of accomplishment when the money they earned over an entire summer of hard work goes towards approximately one month of tuition, or a sense of futility. I think Paul’s idea of starting them on investing is actually very good, and donating to charity is a good habit to start too. Or maybe, instead of tuition, they could be saving for college expenses that they have more control over (spending money, fun extras like study abroad, eating out vs. peanut butter sandwiches, etc) so that they learn some budgeting skills.

There are online stock simulators that you can get them started learning about investment with while they save for shorter term goals like college- might be a cool way to get them excited about it rather than just “Mom says I have to do this with 15% of my money.” You could do one together as a group, or get everyone a separate simulation and make it a contest!

Very late to the party but teaching kids early about. Compound Interest is life changing. Opening a Roth, even with just $200, in high school and teaching the habit of saving for retirement will set them up for ever.

My 4 year old can tell you the only two ways to make money (going to work and compound interest). My two year old can tell you what compound interest is (money making money!!)