“Not too terrible!,” is the short answer if you’ve got stuff to do.

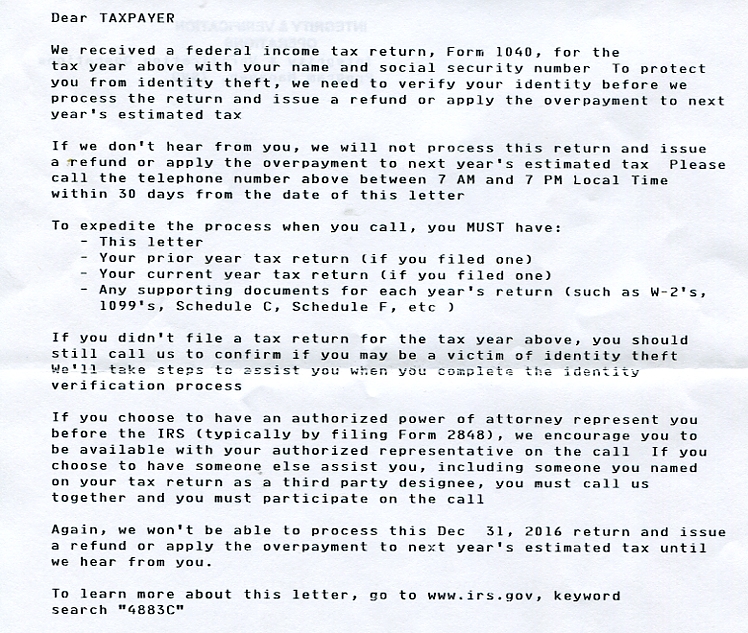

Here’s what part of Letter 4883C looks like:

It is signed “Sincerely yours, INTEGRITY & VERIFICATION OPERATIONS,” which is a little funny if you are still in the mood to laugh after receiving a letter from the IRS. “Sincerely yours”! And then all-caps! From not-a-name-of-a-person! It’s funnier to me now that I’ve already dealt with the letter.

The whole thing looks shady as heck, so first I spent some time verifying that it was a real letter from the real IRS. But they use the real IRS website on their letter, and a real IRS phone number, and the real IRS website has a section on this letter. Also, the postage is paid by IRS.gov.

I looked up online to see if I could figure out why we got the letter, but apparently it’s a bit like getting pulled out of line at the airport for additional checking: sometimes it’s for a reason and sometimes it’s not, and most of the time you don’t get to know the reason. I also found reports of waiting 1.75 hours on hold to speak to an agent, so I waited until I had a whole afternoon ahead of me, and I had a book available.

They want you to have available your tax forms from the most recent filing and the previous year’s filing, including all schedules, W-2s, 1099s, etc. This gave me some anxiety: I was worried they would ask for some information and I would have to riffle endlessly through papers to find it. (This is exactly what happened, but they are used to it.) So I put all the stuff in piles on the bed to at least reduce the number of papers I would have to riffle through for each question: a pile for the tax return itself, a pile for the W-2s, a pile for the 1099s, and a pile for everything else—in two rows, one row for 2015 and one for 2016.

Then I dialed the number. They give you an estimated hold time right at the beginning, which I appreciated: if they’d said two hours, I would have called back another time. But they said 15 minutes, and that’s about how long it was. They are, as it turns out, the type of business that thinks you want a voice to come on the line every 20 seconds to thank you for holding and assure you that all available agents are helping other customers, and then remind you again to have your tax returns, W-2s, 1099s, etc.—so that was annoying. But tolerable.

An agent came on the line sounding like this was not his dream job but he didn’t blame me personally. He also had a cold. Imagine Robert De Niro, two years from retirement at a depressing desk job, and with a headcold. He’s not mean, he’s just really tired and he’s not having any fun.

Anyway! What was clearly happening was that he was reading off a screen as it told him what to ask me. He asked if I had received a letter asking me to call this number, and which letter it was, and whether I was calling on my own behalf or someone else’s; then I think he asked for the name or names on our tax return, and then for the first Social Security number on the tax form. Then he asked several other questions. One was how many dependents we had claimed in 2015. Then he asked for the Social Security numbers of those dependents. I had to riffle to the very last page of our taxes; I used the Coping Thought of “This must happen to pretty much everyone.” After I’d listed four of them, he said sorry, he needed me to go back to the beginning and tell me their full names. Then he needed me to go back to the beginning and tell me their dates of birth. There was apparently some issue with the fifth dependent not showing up on his screen, but that seemed to be an issue only for him, not for me: that is, he was keeping himself from saying his computer was stupid, but he didn’t give me any feeling that my forms were the problem. He said he could see it was five dependents but that for some reason it wouldn’t show him the fifth. Robert De Niro sigh, and a big long sniff followed by another sigh because he cannot stand to blow his nose even one more time today.

He asked if I’d worked in 2016, and I said I had, and he asked for my employer, and I told him the name of the in-home elder care agency, and he said “Excellent, yes.” Then there was a silence as he typed. I felt uncertain, because I also earn money from the ads on this blog, but that’s called “non-employee compensation”—so should I mention that or not? I decided to err on the side of MORE information, so I said into the pause that I wasn’t sure if this was the time to mention it, but I also had non-employee compensation. He said “From who?” and I told him, and he said “Perfect!” in a voice that to me communicated “Good girl, you got it right!”—I mean, in a good way, not in a condescending way. More like I had given the right answer and he was pleased. I was feeling as if however he felt about his job, he and I were getting along and he didn’t mind this call as much as he minded some.

I think that was all he asked. When he said something about number of dependents being weird, I said I wondered if it had anything to do with one of our dependents turning 18 this year—he’s still a dependent, but he no longer gets us the Child Tax Credit, so…maybe? And the agent said yeah, maybe so, and then he said “I mean, it’s not like we got two forms from you or anything, so it must be something like that.” And I seized upon this and said, “So it doesn’t look like it’s an identity theft issue? I was worried that maybe someone else filed a form using our names,” and he said, “No, no—we just got the one form, so something else must have triggered it.”

He put me on hold for about five minutes while he “returned the tax return to the queue for processing,” and then came back and said everything was all set and started reading off a screen again, something about now the forms were submitted for processing and I should call some other number if the refund wasn’t completed in 9 weeks.

And then it was done! The whole thing took about 40 minutes, about half of that time on hold and half talking to the agent. It was a little scary to get the letter and a little scary to deal with it, but in the end it was okay. Well, or we’ll see how long it takes to get the refund now.

Update: I thought it might be good to add a data point for how long it took to get the refund after this. I called them on April 24th, and we got our refund on May 11th: 2.5 weeks. That’s better than I was expecting.

Thank you so much for this post! This is exactly the sort of thing I get so anxious about I put it off until it’s actually a problem, so knowing what your experience was like will help me with just dealing with it in the future.

Several years ago, when my daughter was about 3, I got a letter from the IRS stating, “You owe us [thousands of dollars]” and no explanation. Upon further exploration, it turned out that it was a Social Security issue. They were disallowing our daughter as an exemption because they had her name wrong. For example, we named her Firstname MyMaiden Lastname. Pretty typical, no hyphenation. Three years later, they decided her name was Firstname MyMaiden-Lastname and so she didn’t match what they had in their files. Here’s the best part. I had to go to Social Security, and I couldn’t bring her birth certificate because “that’s where we got the information in the first place.” I had to go to the doctor’s office, since she wasn’t in school yet, and get medical records to show that her last name was, in fact, Lastname. It was a lot of stress and bother (especially getting the “you owe us thousands” letter from the IRS) and, once I finally got in to see somebody at Social Security, it was settled in minutes. Why couldn’t they just start with “We have a discrepancy with your child’s name” ?

This is a ridiculous statement, but it is SO GREAT to get a customer service person who is helpful and efficient! Second, related, ridiculous statement: It makes the experience SO MUCH better!

I am saying these things like they are heretofore-unknown marvels because I just spent the morning calling three different institutions about the same thing and talking to a wide range of customer service people and MAN, the good ones make ALL THE DIFFERENCE.

Why in the world don’t they use periods in their letter? I would realllly love to know their reasoning. That makes it look shadier, if you ask me.

(You write such helpful posts!)

Ha! It looks like my scanner thought they were dust and filtered them out: I checked the original letter and it does have the periods.

I have gotten 6 (six) letters from the IRS – three separate ones, each in duplicate sent separately, informing me that they are changing my address. The change? Adding and taking away periods from abbreviations.

I love your Coping Thought of “This must happen to pretty much everyone.” I’m going to tuck that one away. :)

I second that! Definitely tucking that away for future reference!

Thank you for posting this! I totally would have thought that letter was a scam and ignored it. (well, for a couple of days anyway until I got nervous and dug in.)

I didn’t even know this was something that could happen. I always appreciate your posts like this.

You got the letter because you did a FAFSA for Rob this year. There was a data breach with the FAFSA tool that could possibly result in identity theft/fraudulent returns being filed on your behalf. I work for an online security company :) Sounds like all is well! I would monitor your credit reports though, just to be safe. As we all should these days. Ugh. Stupid cyber criminals.

Oh, interesting!

Here’s a link if you’re curious about the breach.

http://www.pbs.org/newshour/rundown/feds-pull-fafsa-tool-potential-data-breach/

I’ll tell you when this letter IS terrible to receive. When it’s related to your 93 year old grandmother’s tax return, which you handle for her because she is… 93!!! And then you aren’t allowed to talk on the phone with them because you might be committing fraud, but she can’t hear. Or see very well, for that matter. So you have to develop a system where you write signs quickly in giant letters and have her read them to the people, while shuffling through the papers to find the answers. Because even if she could HEAR the person asking for her AGI from 2010 (which she can’t) she definitely wouldn’t know what that was, and even if she did, she wouldn’t be able to read it off of the tiny form. Which has happened the past 2 years. I pray that this doesn’t occur again. Because even though the person on the other end has been pleasant every time, I’ve been a stressed out, hot and sweaty messy by the end of it. And the other option? If I’m not able to prove it to them over the phone? Take her in to the Social Security office. Which is exactly what I want to do with a 93 year old. /rant

I think my mom had to help her bed-ridden, blind, deaf aunt with this. Because she had power of attorney, she was allowed to answer for her. I hope that helps.

I have POA. The federal government, or at least the IRS, does not recognize a POA (which is governed by state law). There is some document I could obtain from the SS Administration, but it would, again, require taking her in to an appointment.

I remember getting my mom to sign her taxes about a month before she died. She was under hospice care. Death and taxes, indeed.

I’m delighted you make money from this blog. If you need me to view more ads I will. It’s a very small price to pay for your service. thank you.

I feel like you have grown so much, lady. Making calls, dealing with the stress, shuffling papers? WELL DONE!!! Is it weird to be proud of someone you don’t know?

I have been doing my own returns via turbotax and this is the first time I got the 4883C letter. I was alarmed and scared. Thank you for this post. I will call them tomorrow morning. Is this just really Identity verifications?

I think I got acute onset dyslexia from that scanned letter. Man that looks atrocious!

The whole thing DOES look pretty shady. (I mean, obviously it wasn’t, but it would certainly appear that way at first glance.) I’m getting nervous thinking of all the people who must have thrown theirs out, thinking it was fake!

I just received this letter too. Thank you so much for writing this post, as well as all your others. It is so comforting to a) know I’m not alone, and b) know what to expect when I deal with it. Thank you thank you!

Just got this letter. I put it off for months from aniexty. Thank you for giving some insight.